Africa has been always considered the world’s mining hub. However the recent governments policies are pushing companies and investors to develop a local supply chain to leverage existing mineral resources and competitive conversion costs. The region shows several opportunities and at the same time challenges which should addressed.

5 MIN READ

AUTHORS: C. Iacò , C. Bansal

INTRODUCTION

The global lithium-ion battery market is undergoing unprecedented growth, fueled by the rapid expansion of electric vehicles (EVs), renewable energy storage solutions, and portable electronics. With governments worldwide pushing for electrification and carbon neutrality, the demand for batteries is expected to soar, creating new opportunities across the supply chain.

Traditionally, Africa’s role in the battery industry has been centered around raw material extraction, with limited local beneficiation.

Africa holds some of the world’s largest reserves of critical battery materials, making it a key player in securing the future of battery manufacturing. DRC has 48% global cobalt reserves and 72% production; South Africa has 38% global manganese reserves and 35% production. 5 countries have 4 or more of the key battery raw materials available. Despite these advantages, Africa has historically played a limited role in value-added processing and battery production.

However, as global markets prioritize supply chain resilience and sustainability, there is an increasing push to develop refining, cathode/anode material production, and even cell manufacturing within Africa. This shift presents a significant economic opportunity for African nations to capture more value from their resources.

This report highlights the potential for Africa to transition from a raw material supplier to a major player in lithium-ion battery manufacturing. It provides key insights into the evolving market dynamics, emerging investment opportunities, and the strategic actions needed to position Africa at the forefront of the global battery boom.

BUILDING THE VALUE CHAIN: FROM EXTRACTION TO CELL MANUFACTURING

Africa has long been a key supplier of raw materials for the global battery industry, but its role has been largely limited to mining and extraction. Currently, most of its lithium, cobalt, and nickel are exported for processing and cell manufacturing in China and other regions, preventing African nations from capturing higher-value segments of the supply chain.

However, a shift is underway as governments and investors recognize the need to move beyond raw material extraction and build local refining, cathode/anode processing, and even cell manufacturing capabilities. Countries like Morocco, South Africa, Zimbabwe, and Nigeria are beginning to invest in refining and battery production, while policy incentives and localization efforts are creating an environment for further growth.

Government Policies to Protect Local Industry & Promote Local Refining

To maximize economic benefits, several African nations have introduced export bans on unprocessed raw materials to promote local refining and processing. Countries like Zimbabwe and the Democratic Republic of Congo (DRC) are mandating in-country processing of lithium and cobalt to encourage investment in refining infrastructure, create jobs, and attract foreign capital. Additionally, tax breaks and subsidies for refining plants further support this transition. While these policies pose short-term implementation challenges, they are crucial for positioning Africa as a key global player in the lithium-ion battery supply chain.

For Africa to establish itself as a competitive player in the battery industry, infrastructure development, technology partnerships, and strategic investments will be critical. By developing a complete value chain from mining to cell manufacturing, Africa can maximize the economic benefits of its vast natural resources and strengthen its position in the global battery market.

The Role of Free Trade Agreements (FTAs) in Developing a Local Battery Ecosystem

The African Continental Free Trade Area (AfCFTA) presents a unique opportunity to strengthen intra-African collaboration in the battery value chain. By reducing trade barriers, harmonizing regulations, and facilitating cross-border investment, AfCFTA can help create an integrated battery manufacturing ecosystem within Africa. This would enable raw materials extracted in one country to be refined and processed in another, fostering regional supply chains and reducing dependence on external markets such as Chinese suppliers. Additionally, improved trade facilitation under AfCFTA can lower logistics costs and improve access to essential industrial inputs, making localized battery production more competitive on a global scale.

Implications and Benefits for FTA for African Countries:

Tariff Reduction and Cost Savings:

-Intra-African Trade: AfCFTA mandates the elimination of tariffs on 90% of goods traded between member countries, with plans to eventually cover 97%.This significant reduction lowers the cost of goods, making intra-African trade more competitive.

-Imports from China: In contrast, imports from non-African countries like China are subject to Most Favored Nation (MFN) tariffs. For instance, South Africa imposes an average duty rate of 5.8% on such imports, with some tariffs reaching as high as 45%.

Reduced Shipping Times and Costs:

-Intra-African Shipping: Trading within the continent typically results in shorter shipping distances and times, leading to cost savings and faster delivery.

-Imports from China: Sea freight from China to African ports can take approximately 20-30 days, depending on the specific route and destination. This extended shipping time can lead to higher inventory costs and delays.

Comprehensive Membership and Market Access:

-AfCFTA Coverage: As of now, 54 of the 55 African Union member states have signed the AfCFTA agreement, with most having ratified it.

-This extensive membership creates a vast, unified market, facilitating easier access and distribution for member countries.

Exclusions: While AfCFTA significantly reduces tariffs among member countries, imports from non-member countries, including China, do not benefit from these preferential rates and are subject to standard tariffs.

MARKET DEMAND & INVESTMENT POTENTIAL

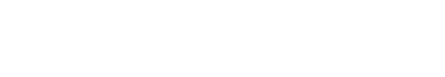

The demand for lithium-ion batteries in Africa is growing rapidly, driven by the rise of electric mobility (2W & 4W) and energy storage (BESS). As Southern, Central, and Northern Africa transition towards electrification and renewable energy, the need for localized battery production is becoming more evident.

- Southern Africa is leading in 4W adoption due to higher urbanization and infrastructure development, with demand expected to grow significantly from 2.61 GWh in 2024 to 6.04 GWh by 2030 at a 15% CAGR. However, the 2W segment remains relatively small, with projected demand reaching only 0.08 GWh by 2030, indicating limited penetration of electric two-wheelers.

- North and Central Africa show strong growth in the 2W segment, where demand is expected to increase from 0.42 GWh and 0.34 GWh in 2024 to 0.97 GWh and 0.77 GWh by 2030, respectively. This is driven by the need for affordable and efficient last-mile mobility solutions, making electric two-wheelers an attractive alternative.

- The BESS market is the largest segment, fueled by increasing reliance on solar energy and grid instability. Many African regions face frequent power outages and unstable grid infrastructure, leading to a strong business case for battery storage. Africa’s electricity access rate is only about 43% on average, with some regions below 30%. Many industrial and commercial users rely on diesel generators, increasing the demand for renewable energy storage solutions to ensure energy security and cost reduction. Demand is set to grow from over 9.75 GWh in Southern Africa, 10.2 GWh in North and 11.25 Central Africa in 2024, to 15.47 GWh, 15.5 GWh and 17.85 GWh respectively, by 2030. This reflects the urgent need for energy storage solutions to balance intermittent renewable power sources.

WHY AFRICA? WHY NOW?

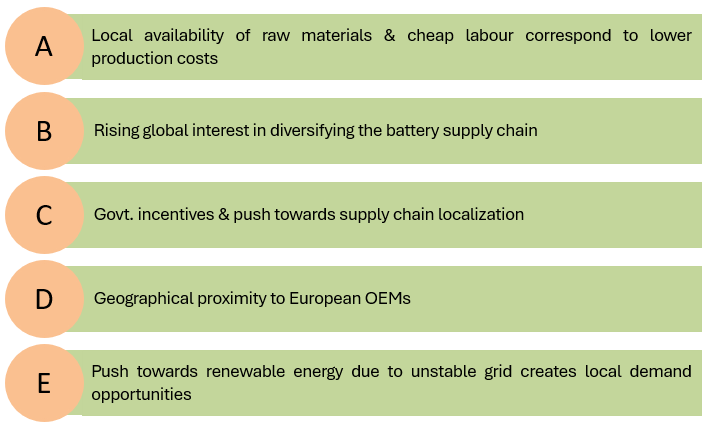

As the global battery industry seeks to diversify supply chains and reduce dependence on China, Africa presents a unique opportunity to become a competitive player in lithium-ion battery manufacturing. Compared to regions like China, Australia, and South America, Africa offers lower labor and energy costs, making it an attractive location for refining and processing. Furthermore, with projected local demands, local cell manufacturing also plays an attractive suit in Africa.

While China remains the dominant force in refining and manufacturing, South American countries are already investing in localized refining to capture more value from their resources. Now, African governments are following suit, introducing policy incentives, investment-friendly regulations, and export restrictions to encourage local refining and manufacturing.

With abundant raw materials, cost advantages, and increasing government support, Africa is positioned to emerge as the next key player in the global battery value chain.

CHALLENGES AND SOLUTIONS

How to address Africa region challenges as lack of infrastructure, investments and know how.

Public-Private Partnerships (PPP) for Investment in Refining & Cell Manufacturing

-

Government Incentives:

- Tax breaks, low-interest loans, and subsidies to attract private investors.

- Secure long-term power and infrastructure support to reduce operational costs.

-

Private Investment:

- Engage mining companies and global energy firms to invest in local value addition.

- Develop government-backed risk mitigation mechanisms to attract foreign direct investment (FDI).

-

Regulatory & Policy Support:

- Enforce policies that mandate local refining before exporting raw minerals.

- Provide transparent and stable legal frameworks to boost investor confidence.

Successful Examples:

- Morocco: The country has developed a strong automotive and battery sector by offering attractive policies to private investors.

- South Africa: Has successfully leveraged PPPs in its energy sector to attract private capital in infrastructure projects.

Special Economic Zones (SEZs)

-

SEZ Development with Tax Benefits:

- Create zones near mining regions to reduce logistics costs.

- Provide tax exemptions on equipment imports and corporate income tax reductions.

- Offer low-cost energy solutions (e.g., renewable energy integration).

-

Shared Infrastructure & Industrial Clusters:

- Develop centralized industrial parks with power, roads, and water supply.

- Foster collaboration between component manufacturers, recyclers, and cell producers.

-

Skilled Workforce Development:

- Partner with universities and technical institutes for workforce training.

- Offer scholarships and vocational training programs focused on battery production.

Successful Examples:

- Ethiopia’s Industrial Parks: Have attracted foreign investment in textile and manufacturing sectors.

- Egypt’s Suez Canal Economic Zone (SCZONE): Offers a model of how SEZs can drive industrialization.

Global Collaborations & Joint Ventures (JVs)

-

Technology Transfer Agreements:

- Negotiate partnerships with global players (China, EU, USA) for skill and knowledge transfer.

- Provide incentives for international firms to set up local assembly and production plants.

-

Joint Ventures with Established Battery Firms:

- Collaborate with global automakers and energy companies investing in battery supply chains.

- Ensure local ownership and participation in JVs to retain value within Africa.

-

Research & Development Investments:

- Establish partnerships with global battery research institutions.

- Develop African-based innovation hubs focused on battery chemistry, recycling, and alternative materials.

Successful Examples:

- Democratic Republic of Congo (DRC): Partnering with global battery companies to establish a lithium battery precursor production plant.

- Rwanda: Working with international partners to develop lithium battery recycling capabilities.